Employees who claimed home office tax relief during the pandemic could end up paying more tax this year

Martin Lewis: Worked from home due to coronavirus before 6 April 2022? You can still claim tax relief worth up to £280

HMRC - If you're working from home because of Covid-19 you may be able to claim tax relief. It's quick and easy to do on gov.uk 💻 Check if you're eligible 👇

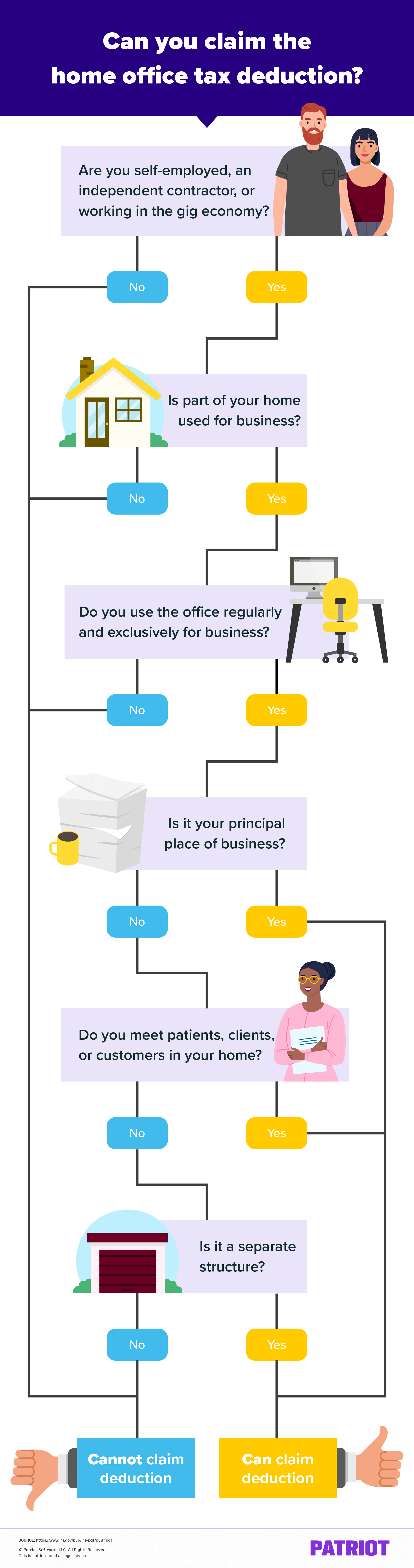

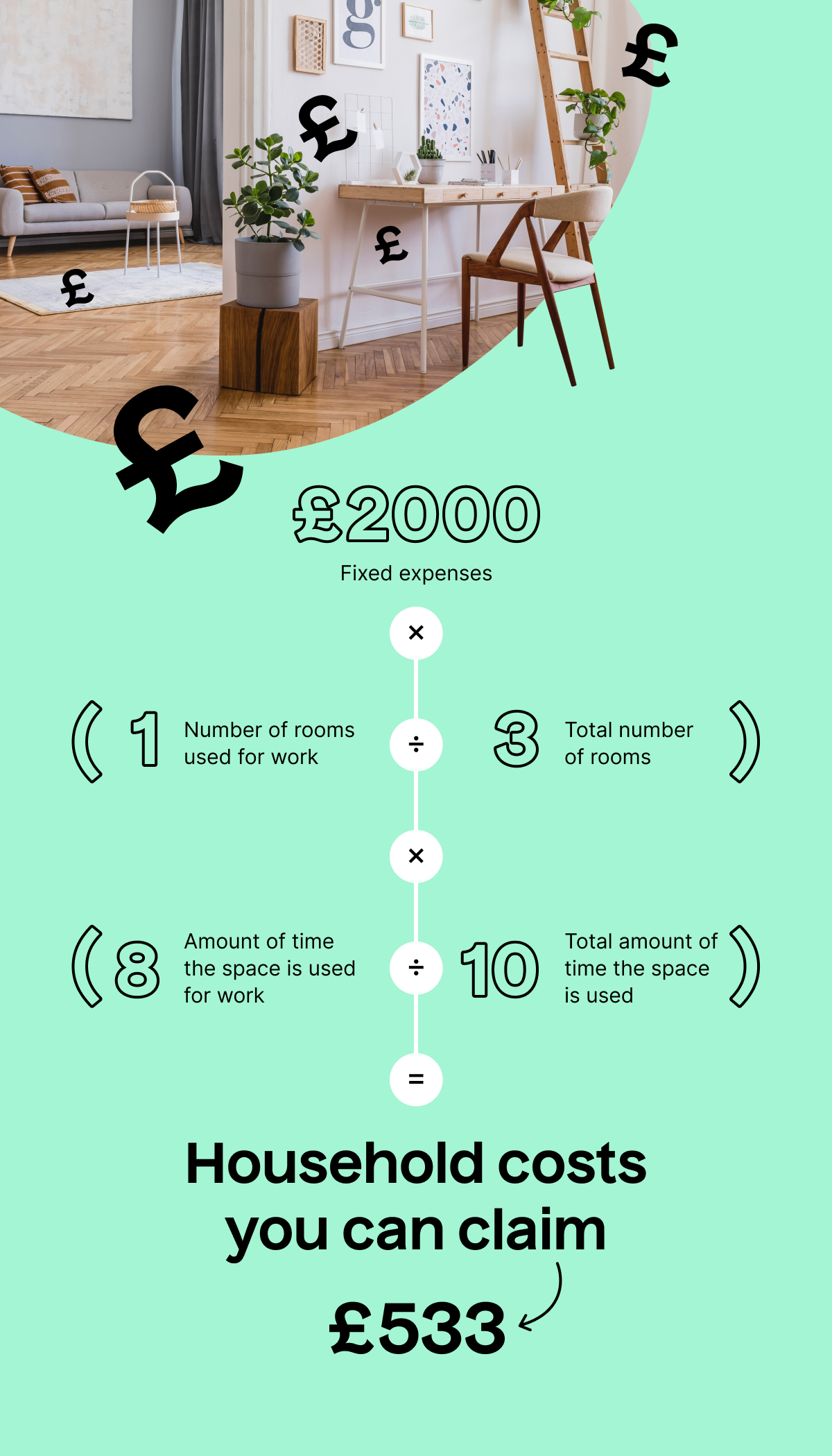

Coronavirus (Covid-19) – claiming home-working expenses Normally claims for tax relief for unreimbursed home-working expenses