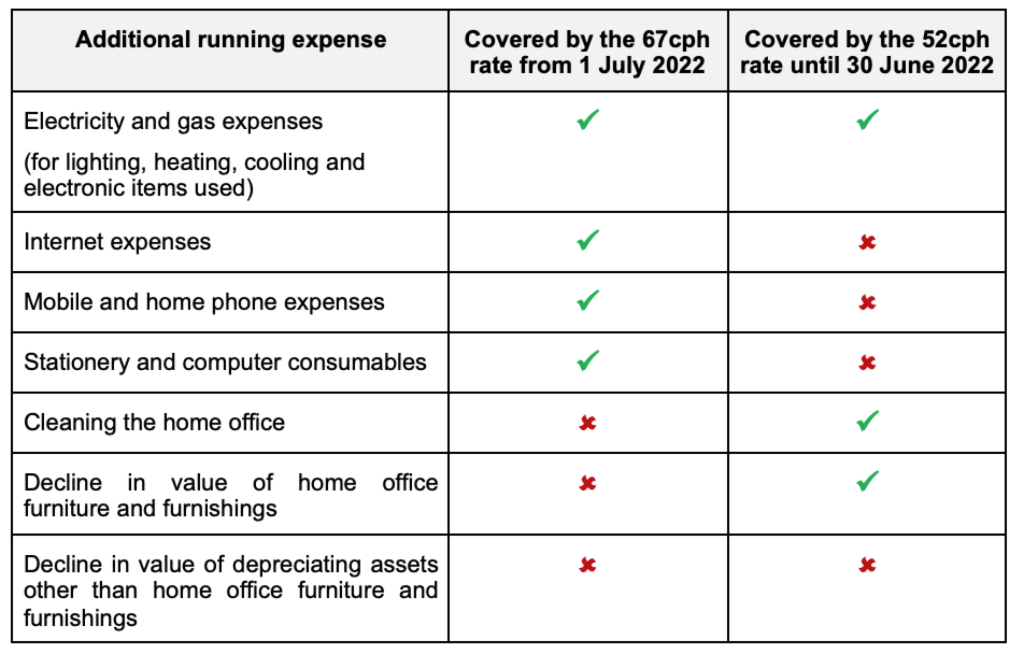

The Enterprise Edge - Are you calculating your expenses for your tax return? Have you worked from home during the last financial year? Here are 3 methods to calculate your home office

Home Office Expenses 2022 | Financial and Administrative Services | Memorial University of Newfoundland

What home office expenses can I claim as a limited company director? - West Lancs Chartered Accountants

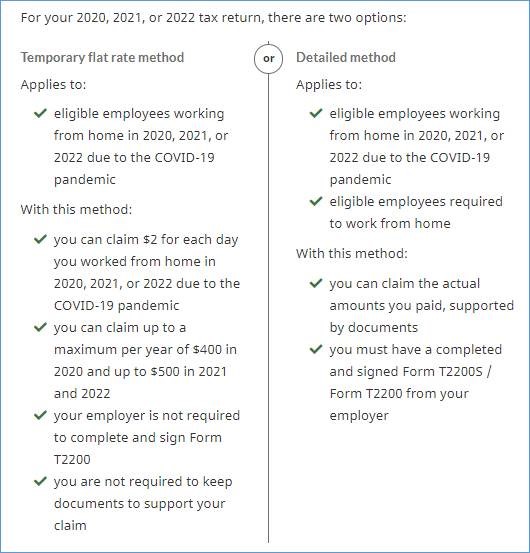

Karen Vecchio, Elgin-Middlesex-London - Working from home? Here's info on how to claim expenses for your 2020 tax return - Canada Revenue Agency (CRA) has made the home office expenses deduction available

:max_bytes(150000):strip_icc()/TermDefinitions_Fixedincome-87c41e15f4be4e7ba40572ebdef620a4.jpg)