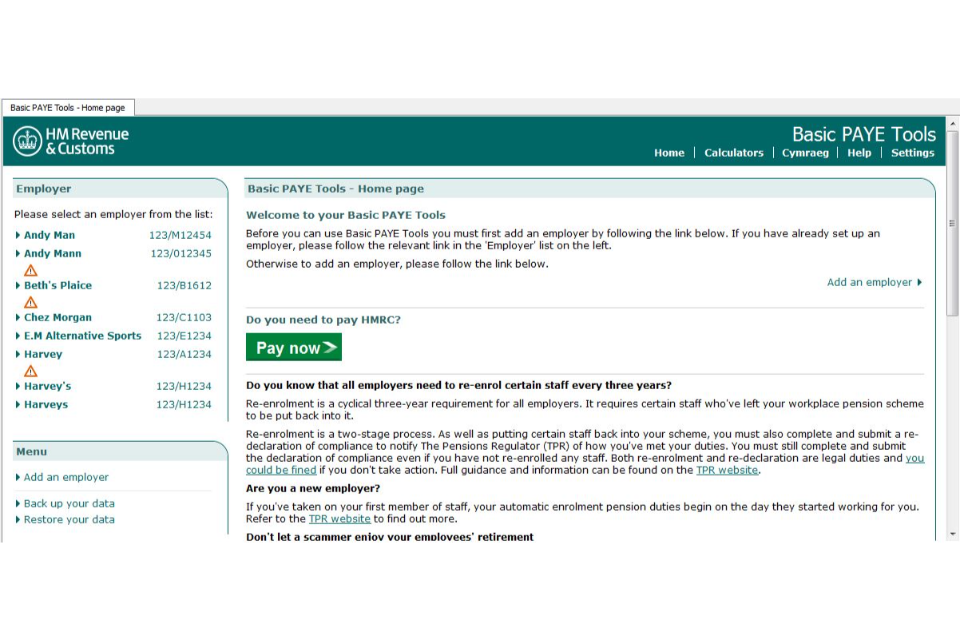

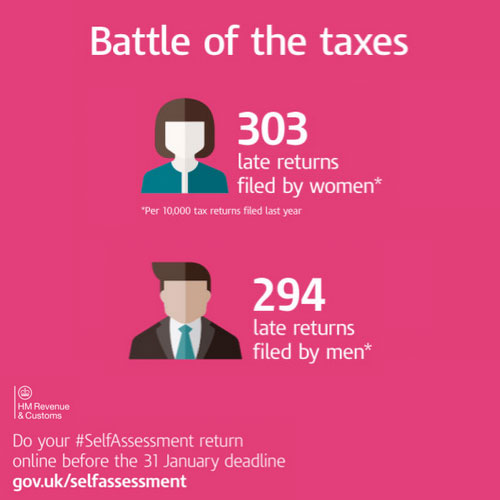

HMRC self-assessment warning that millions have three days to avoid tax deadline fine - Wales Online

HMRC Letter about late filing of tax return on a table with envelope, pen and calculator Stock Photo - Alamy

Self-Assessment late payment penalties relaxed but interest still accrues | Accountants Bury St Edmunds & Thetford - Knights Lowe